Right now, across the globe a persistent chorus of economists, politicians and commentators are urging Governments to stop printing and start ‘doing’.

The emergence of this growing army of fiscal stimulus advocates, has been galvanised by weakening economic conditions in many countries once considered bastions of economic prosperity.

If we asked you which leading European economy has fallen from fourth spot to twelfth in world ranking for infrastructure quality, who would you guess?

And what if we told you, in this very same nation, the availability of latest technologies had also deteriorated versus developed world peers?

Perhaps you may guess the UK or Italy, but the country in question is Germany – a wealthy nation flush with savings.

Central banks failing to pack a punch

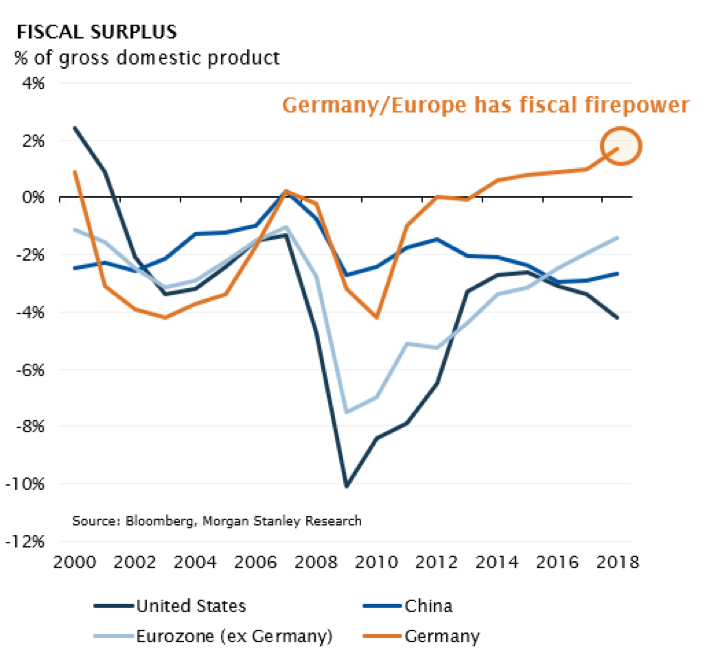

Germany has a fiscal surplus of 2% of GDP and a current account surplus of 7% of GDP[1]. On the one hand we have a country that is on the brink of recession, yet on the other hand it has the ability to internally fund desperately needed infrastructure investment.

The move to spend remains held back only by Germany’s desire to balance their budget, which may need rethinking in a world where Germany is being paid to borrow money.

Since the global financial crisis economic policy has been outsourced to central banks which have relied on their monetary toolkits – primarily cutting interest rates and embarking on quantitative easing.

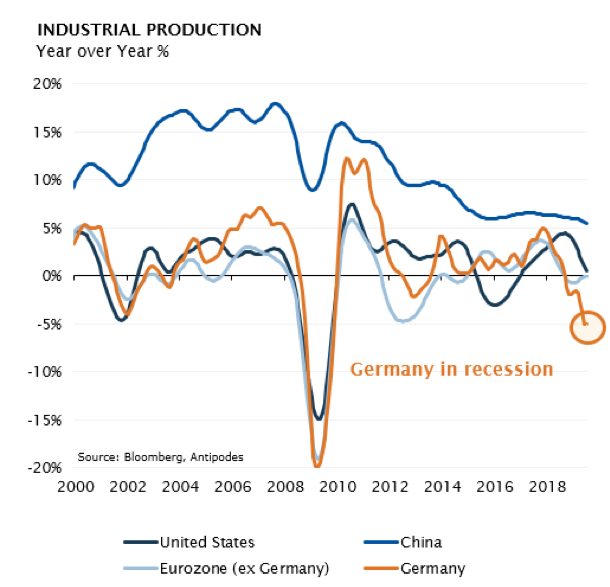

Fast-forward to today, as you can see from the chart below, monetary policy (while inflating asset prices) has failed to generate a self-sustaining rebound in economic activity.

Germany used to be the healthy part of Europe, but it is now underperforming the Eurozone due to the global trade slowdown. The US – previously the last man standing – is also following Europe as the effects of tax-cut stimulus fade away.

Not only has monetary policy failed to stimulate real economic activity (jobs, capital investment), it has reinforced increasing inequality which has led to a rise in populism across the globe.

A rise in populism typically leads to protectionist policies and a rise in regulation. This, in turn, feeds back into weaker growth and more populism. Central Banks then respond with more monetary stimulus which continues to fail to create demand.

And here we find ourselves in a negative feedback loop. If monetary policy isn’t working, then what is the solution?

The only option is fiscal stimulus

Ultimately, we believe it is inevitable that countries will seek to generate growth through fiscal stimulus. We have seen this already in the US.

As you can see from the chart below, China and Europe have the most dry powder, while the US is running emerging market-style twin deficits.

Europe – driven by Germany – has long favoured fiscal austerity. Germany lives under the ‘Schwarz-null Policy’ – a policy of aiming for a budget that’s balanced or in the black. It has pushed the rest of Europe to live within its means, even if that meant fiscal contraction in the immediate aftermath of the Global Financial Crisis. Given the current economic backdrop, is Germany prepared to loosen its grip given the firepower it has to stimulate the domestic economy? We believe it is.

In recent times the rhetoric out of Europe has pivoted towards the need for fiscal policy as an additional tool for stimulus. We believe the chorus will grow louder due to a confluence of new leadership, Christine Lagarde as President of the European Central Bank and Ursula von der Leyen as President of the European Commission, and the pain being felt in the German industrial heartland[1].

Mario Draghi, outgoing President of the European Central Bank (which is responsible for managing monetary policy in the Eurozone) recently indicated he believes monetary policy has reached its limits and governments must look towards fiscal stimulus.

“In view of the weakening economic outlook and the continued prominence of downside risks, governments with fiscal space should act in an effective and timely manner,” said Draghi.[2]

ECB President-elect Christine Lagarde, who will shortly replace Mario Draghi, has similarly called on European governments to launch fiscal stimulus.

“Central banks are not the only game in town,” Lagarde told the European Parliament in her recent nomination address.

“There is clearly co-operation to be had if all the institutions in Europe – and the Eurozone in particular – want to respond to the threat of populism,” she added.[3]

Prominent German business leaders are also calling for their government to loosen the purse strings. Siemens CEO Joe Kaeser has advocated infrastructure investment over a strict balanced budget to generate economic activity[4]. Angela Merkel stepping down as German Chancellor in 2021 could provide the catalyst for change.

The political shifts in Germany should not be underestimated, power is shifting towards both Green and nationalists that are making increased demands.

We have already seen some action. The recent announcement from the German coalition for a €50b package to reduce carbon-dioxide emissions targeting transport and heating is a step in the right direction. At over 1% of GDP this proposal is significant, and it’s a similar size to the stimulus packages announced in 2009, following the global fiscal crisis[5].

Elsewhere in Europe, the famously tight Dutch government has indicated €3bn (0.4% GDP) in additional investment and tax cuts for households to protect the country’s economic growth[6], and the potential to create a special investment fund of up to €50b which will focus on infrastructure, education and innovation[7].

What will European fiscal stimulus mean for equities?

Germany, but also more broadly Europe, faces weakening global positioning with respect to infrastructure in areas such as ports, railroad, power grids and broadband. Investments in these areas can boost employment and competitiveness. The signs point to infrastructure spend with a ‘green’ tilt, and potentially schemes with a pro-worker stance given the state of the auto sector, one of the largest employers in Germany.

What’s to stop a car scrappage scheme like that enacted in 2008/09, but this time one designed to increase demand for hybrids and electric vehicles while also supporting the auto sector? Or investing more aggressively in grid renewal, given the German government’s target for c. 65% of energy to come from renewables by 2030?

European Commission (EC) President-elect Ursula von der Leyen proposed a European ‘Green Deal’ in her election address. With €1t in hoped-for expenditure, it promotes a swathe of pro-climate policies with a goal of pan-European carbon neutrality by 2050. If funded via the European Investment Bank (EIB) the EC can embark on significant expenditure with relatively little wider political interference.

There’s historical precedence of this with the 2014 Juncker plan[8]. The French and German governments have thrown their weight behind President-elect von der Leyen’s proposals indicating support for potentially introducing a green border tax adjustment to maintain the integrity of European climate policy[9].

Stocks such as Siemens (utility scale gas turbines, renewables and smart grid), Electricite de France (nuclear and renewable energy), Continental (key components for electrification of vehicles) are examples of companies in Antipodes’ portfolio which will benefit from infrastructure stimulus measures.

Many more beneficiaries will emerge in the fullness of time as more policies are formed.

The potential for fiscal stimulus extends beyond Europe

China has made some inroads into reducing excess capacity and improving the overall quality of economic growth, though given the re-leveraging of the economy that occurred post the Global Financial Crisis, overall financial leverage remains high and rising, and has caught up to the US on total debt to GDP basis.

As can be seen from the earlier chart, China still has some firepower to stimulate. The US-China trade war will accelerate the path of rebalancing the Chinese economy toward internal growth and a smaller current account surplus. Chinese fiscal stimulus will target lower income demographics. For example, discretionary consumption stimulus on top of the income tax and VAT cuts, as well as some infrastructure spending, which we have already seen to date. This stimulus will increasingly require funding by higher wealth, luxury and property taxes and effectively take the form of income redistribution from rich to poor.

Antipodes holdings such as Alibaba, Yum China and Ping An Life Insurance are all well positioned for Chinese policies targeting income stimulus and a strengthening of the social safety net.

Staying east, India has also recently announced corporate tax cuts to the tune of 0.8% of GDP to support the domestic economy. ICICI Bank (one of the largest retail banks in India) will be a direct beneficiary.

Where to from here?

With central banks seemingly committed to monetary stimulus and bonds telling us that we are living in a low-growth world, are growth and inflation really dead? And what does this mean for investors?

We believe the biggest change to the landscape is a rise in populism, and we don’t think this is going away as it’s an outcome of central bank policy which has inflated asset prices rather than delivering a sustainable recovery in economic activity. Ultimately economic reforms are required to generate sustainable productivity growth, but we expect to see a growing call for fiscal stimulus as the short-term solution to a rise in populism.

What will this mean for bonds and bond-like equities which have now grown to account for more than 40% of the global market cap?

How balanced is your portfolio?

[1] On top of Germany’s industrial economy contracting 5% yoy, German exports are contracting around 3% pa. Source: Factset.

[2] Source: Draghi’s Utmost Is Still Not Enough (Bloomberg, 13 September 2019).

[3] Source: Lagarde calls on European governments to launch fiscal stimulus (Financial Times, 4 September 2019)

[4] Source: Siemens chief criticises Merkel’s balanced budget mantra (Financial Times, 10 September 2019)

[5] Source: Merkel Seals $60 Billion Deal in New Attempt at Climate Targets (Bloomberg, 20 September 2019)

[6] Source: Netherlands rolls out economic stimulus plan as downturn looms (Financial Times, 18 September 2019)

[7] Source: Dutch Lash Out at Negative ECB Rates as Pension Funds Suffer (Bloomberg, 13 September 2019)

[8] The “EU Infrastructure Investment Plan” was announced by European Commission President Jean-Claude Junker in 2014 and enacted upon in 2015. The plan surpassed the original €315b investment target and is set to create 1.4m jobs and increase EU GDP by 1.3% by 2020. Source: https://ec.europa.eu/commission/news/juncker-plan-exceeds-original-eu315-billion-investment-target-2018-jul-18-0_en#targetText=President%20Jean%2DClaude%20Juncker%20said,GDP%20by%201.3%25%20by%202020.

[9] Source: Reuters. The purpose of a green border tax adjustment is to prevent the reallocation of carbon-intensive production to non-EU countries to avoid carbon costs, reducing the effectiveness of European climate policy.

[10] Source: Bloomberg