Korean regulators look like they may be following the path carved by Japan with the recent announcement of their Value Up program of corporate reform.

This podcast episodes takes listeners inside the world’s largest truck manufacturer.

Alison Savas and Andy Gibson discuss the state of play in the global auto industry.

Antipodes quarterly video update featuring Portfolio Manager Vihari Ross and Investment Specialist Sam Kazacos.

Vihari Ross outlines Antipodes portfolio positioning and shares perspectives on the outlook for global equities in 2024.

Alison Savas is joined by Jacob Mitchell in this Q4 2023 market update.

In our final podcast episode for 2023, Alison Savas is joined by all Antipodes’ Sector Portfolio Managers. Each PM shares one stock (or area of their coverage) they believe will perform in the year ahead, along wth one stock or part of the market they believe investors should avoid.

The backdrop for investing in Brazil is changing – fundamentals are improving, inflation is falling, rates are falling and policy makers are embarking on fiscal repair.

Investors should take a flexible approach to the outlook for US interest rates given they may remain higher for longer than anticipated.

Every market cycle sees a reshuffling of previous winners due to new investment cycles and disruptive technologies. Is today’s market ready to reshuffle?

This quarterly market update delves into how recent geopolitical instability is impacting the global oil market.

In this episode of the Good Value podcast Alison Savas speaks with Benoit Bazin, the CEO of French-listed building materials manufacturer Saint-Gobain (EPA: SGO).

Watch a replay of Jacob Mitchell’s presentation at the Pinnacle Investment Summit, in September, 2023.

At around 11x times forward earnings, UK equities are the cheapest in the developed world. Alison Savas and James Rodda discuss the opportunities this presents for investors.

Antipodes Portfolio Manager, John Stavliotis uncovers the structural and cyclical opportunities in emerging markets and Antipodes’ pragmatic value approach to investing.

In this quarterly update episode, Alison Savas and Rameez Sadikot discuss what the narrow performance in equities really means, along with how the macro backdrop could impact markets into the third quarter of 2023.

For China, a strategy to align with the developing world provides a significant demand base for its emerging multinational champions you may have never heard of.

In this podcast episode, Alison Savas is joined by Ian Harnett, the founder and chief investment strategist of Absolute Strategy Research.

In this podcast episode, John Stavliotis and Alison Savas explain why investors should hold the line on China and discuss three Chinese stocks to watch.

In this interview with Morningstar Australia, Jacob Mitchell shares insights into investment opportunities in the energy transition, emerging markets, and the US. He also discusses Australian banks.

Jacob Mitchell discusses the outlook for global equities and Antipodes’ portfolio positioning in this presentation at the Morningstar Investment Conference.

This White Paper outlines Antipodes’ thesis on why we think Australian bank shareholders are vulnerable.

Alison Savas and Jacob Mitchell discuss the state of global equity markets following Q1 2023, along with three investment ideas to help navigate the complex market and macro environment.

In this interview with Gemma Dale, Alison Savas discusses Antipodes’ views on what investors should be looking for in global stock markets over the next decade.

Following the recent bank crises in the US and Europe, Alison Savas and James Rodda discuss the vulnerabilities that remain within global financials, along with the relative winners and losers that could emerge.

In this podcast episode, Alison Savas is joined by Siemens Energy CEO, Dr Christian Bruch to discuss the global energy transition and role Siemens Energy is playing.

Antipodes CIO and Lead Portfolio Manager, Jacob Mitchell discusses a fundamentally different regime for global equities in 2023.

Alison Savas and Rameez Sadikot discuss the state of global equity markets following Q4 2022, the investment case for gold and portfolio holding, Newcrest Mining.

In an interview with the Australian Financial Review, Jacob Mitchell shared Antipodes’ views on some of the key topics currently facing global equities investors.

In this special podcast episode Alison Savas goes ‘around the grounds’ within our investment team to provide you sector-specific outlooks for 2023.

In this podcast episode Alison Savas and Antipodes’ Emerging Markets portfolio manager John Stavliotis discuss the key opportunities and risks we see across emerging economies.

Korean regulators look like they may be following the path carved by Japan with the recent announcement of their Value Up program of corporate reform.

Investors should take a flexible approach to the outlook for US interest rates given they may remain higher for longer than anticipated.

Every market cycle sees a reshuffling of previous winners due to new investment cycles and disruptive technologies. Is today’s market ready to reshuffle?

For China, a strategy to align with the developing world provides a significant demand base for its emerging multinational champions you may have never heard of.

In this article, Dr Nick Cameron, outlines the investment case for French healthcare giant Sanofi (EPA: SAN).

Uncertainty is never good for short-term sentiment, but for the long-term investor, it can often present buying opportunities. This is the case when it comes to Chinese equities today, writes Sunny Bangia.

Tencent is a digital empire that is embedded in the everyday life of the Chinese consumer. In this article we examine the company’s growth, it’s valuation and how it’s positioned to weather regulatory risk and other short term uncertainty.

Tencent is a digital empire that is embedded in the everyday life of the Chinese consumer. In this article we examine the company’s growth, it’s valuation and how it’s positioned to weather regulatory risk and other short term uncertainty.

Exposure to Asia can no longer be ignored. Continued strong economic growth, even in the face of severe stress-tests, leaves the region positioned for its much-anticipated period of market leadership. Sunny Bangia explains 3 key drivers of regional growth and how Antipodes is providing exposure.

In this article, Owen Scarrott examines Norsk Hydro – a low-cost and low-carbon producer of aluminium. It is one of the key decarbonisation beneficiaries in Antipodes’ portfolio.

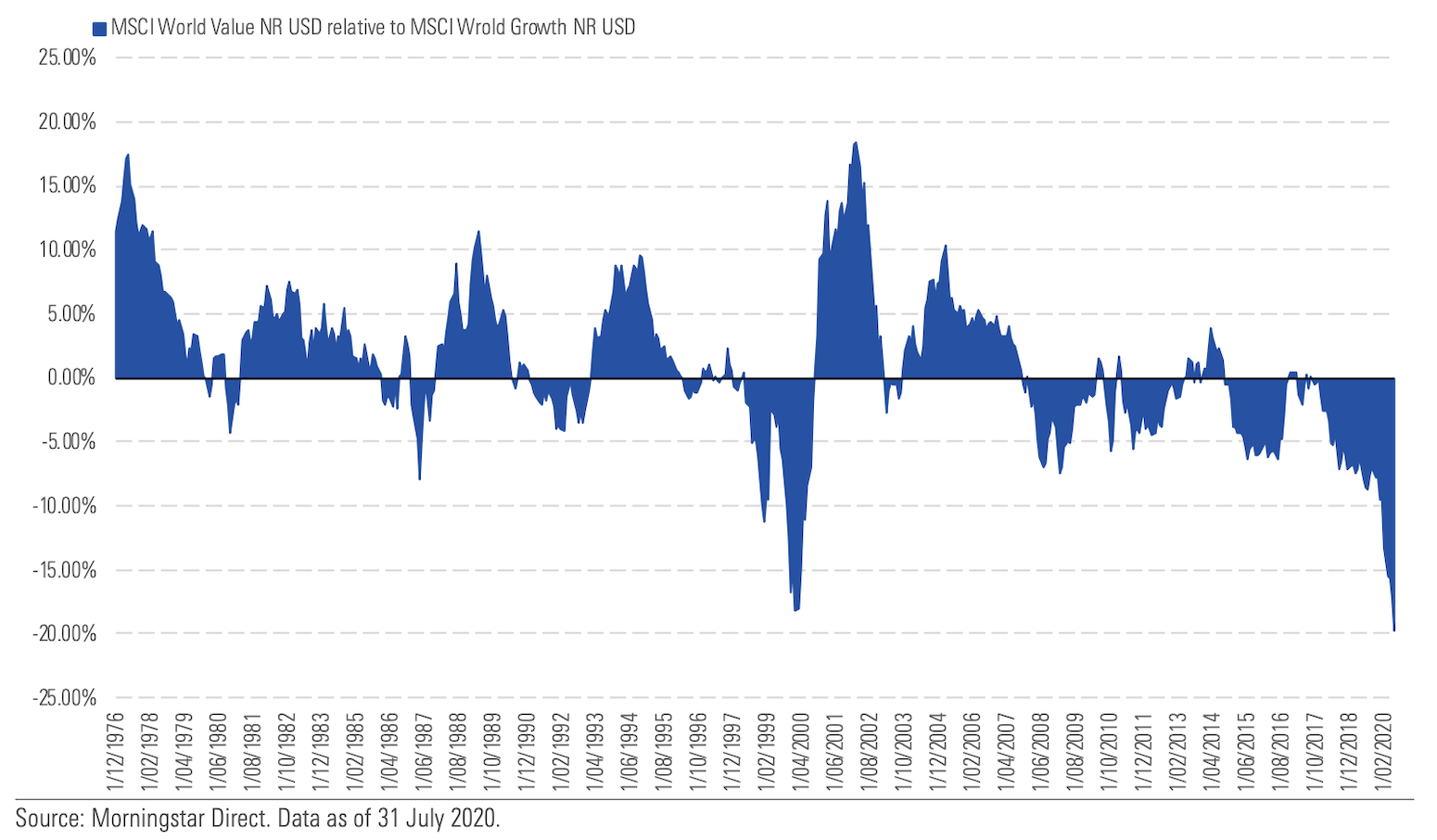

In this white paper, Alison Savas, outlines the central case and key catalysts for a regime change in markets – where investors turn from growth to value.

Could the current market pessimism surrounding financials present a unique investment opportunity? In this article, Vinayak Muralidharan analyses the investment case for one US retail bank with significant embedded value.

Jacob Mitchell explains why it’s more important than ever for investors to maintain a value-style exposure in their investment portfolios.

We’ve witnessed dramatic fiscal and monetary responses to the COVID-19 pandemic. Now we must look at how that stimulus is likely to evolve and consider the longer-term outlook for stock markets in this context.

The oil sell off has largely been at the front end of the futures curve with little change in long term price expectations. In this article, the Antipodes team examines oil supply, demand and the impacts of COVID-19.

COVID-19 webinar series: In this highlight, Antipodes provides views on why we believe Yum China offers a compelling defensive investment opportunity as China enters the COVID-19 recovery phase.

Korean regulators look like they may be following the path carved by Japan with the recent announcement of their Value Up program of corporate reform.

In this interview with Morningstar Australia, Jacob Mitchell shares insights into investment opportunities in the energy transition, emerging markets, and the US. He also discusses Australian banks.

In an interview with the Australian Financial Review, Jacob Mitchell shared Antipodes’ views on some of the key topics currently facing global equities investors.

This Livewire Markets article featuring Antipodes Partners’ Nick Cameron looks at big pharma stock Merck & Co.

In this article, published on Citywire, five fund managers, including Antipodes Jacob Mitchell, discuss how they capitalised on the downturn in US equity markets.

In this article, published on Citywire, Jacob Mitchell explains how the Antipodes team is uncovering long-term secular trends at attractive valuations.

This Livewire Markets article featuring Antipodes’ Jacob Mitchell provides insights into China and US markets and where investors should put their money.

Jacob Mitchell discusses Antipodes’ investment process and the team’s views on equity markets, in a Q&A with Future Generation.

This Livewire Markets article provides an insight into the Aluminium market and one of the world’s largest aluminium producers.

With Valentine’s Day around the corner, several leading investors reflect on the investments that have stolen their hearts in recent times.

As a guest on the Wealth of Experience podcast, Jacob Mitchell was interviewed by Firstlinks Managing Director, Graham Hand. Jacob discussed Antipodes’ investment approach and views on markets and the economy.

This podcast episodes takes listeners inside the world’s largest truck manufacturer.

Alison Savas and Andy Gibson discuss the state of play in the global auto industry.

Alison Savas is joined by Jacob Mitchell in this Q4 2023 market update.

In our final podcast episode for 2023, Alison Savas is joined by all Antipodes’ Sector Portfolio Managers. Each PM shares one stock (or area of their coverage) they believe will perform in the year ahead, along wth one stock or part of the market they believe investors should avoid.

The backdrop for investing in Brazil is changing – fundamentals are improving, inflation is falling, rates are falling and policy makers are embarking on fiscal repair.

This quarterly market update delves into how recent geopolitical instability is impacting the global oil market.

In this episode of the Good Value podcast Alison Savas speaks with Benoit Bazin, the CEO of French-listed building materials manufacturer Saint-Gobain (EPA: SGO).

At around 11x times forward earnings, UK equities are the cheapest in the developed world. Alison Savas and James Rodda discuss the opportunities this presents for investors.

In this quarterly update episode, Alison Savas and Rameez Sadikot discuss what the narrow performance in equities really means, along with how the macro backdrop could impact markets into the third quarter of 2023.

In this podcast episode, Alison Savas is joined by Ian Harnett, the founder and chief investment strategist of Absolute Strategy Research.

In this podcast episode, John Stavliotis and Alison Savas explain why investors should hold the line on China and discuss three Chinese stocks to watch.

Alison Savas and Jacob Mitchell discuss the state of global equity markets following Q1 2023, along with three investment ideas to help navigate the complex market and macro environment.

In this interview with Gemma Dale, Alison Savas discusses Antipodes’ views on what investors should be looking for in global stock markets over the next decade.

Following the recent bank crises in the US and Europe, Alison Savas and James Rodda discuss the vulnerabilities that remain within global financials, along with the relative winners and losers that could emerge.

In this podcast episode, Alison Savas is joined by Siemens Energy CEO, Dr Christian Bruch to discuss the global energy transition and role Siemens Energy is playing.

Alison Savas and Rameez Sadikot discuss the state of global equity markets following Q4 2022, the investment case for gold and portfolio holding, Newcrest Mining.

In this special podcast episode Alison Savas goes ‘around the grounds’ within our investment team to provide you sector-specific outlooks for 2023.

In this podcast episode Alison Savas and Antipodes’ Emerging Markets portfolio manager John Stavliotis discuss the key opportunities and risks we see across emerging economies.

In this podcast episode, Alison Savas discusses the outlook for global equities and provide an update on Antipodes’ portfolio positioning at the end of Q3 2022.

In this podcast episode, Alison Savas and Jacob Mitchell discuss Antipodes’ approach to shorting and examine a recent short position in the Antipodes Global Fund.

In this podcast episode, Alison Savas is joined by Dr Michael Müller, Chief Financial Officer of RWE (ETR:RWE) to discuss Europe’s energy crisis, decarbonisation and RWE’s operations.

In this quarterly market update on the Good Value Podcast, Jacob Mitchell and Alison Savas discuss the state of equity markets in Q2 2022 and Antipodes’ portfolio positioning.

In this quarterly market update on the Good Value Podcast, Jacob Mitchell and Alison Savas discuss the state of equity markets in Q2 2022 and Antipodes’ portfolio positioning.

In this podcast episode, Alison Savas is joined by Gianluca Romano, Executive Vice President and CFO of Seagate Technology (NASDAQ: STX).

In this podcast episode, Alison Savas is joined by one of the world’s leading authorities on digital advertising to discuss Meta and the online advertising landscape.

Antipodes quarterly video update featuring Portfolio Manager Vihari Ross and Investment Specialist Sam Kazacos.

Vihari Ross at the 2024 Pinnacle Insights Series

Vihari Ross outlines Antipodes portfolio positioning and shares perspectives on the outlook for global equities in 2024.

Jacob Mitchell at the Pinnacle Investment Summit 2023

Watch a replay of Jacob Mitchell’s presentation at the Pinnacle Investment Summit, in September, 2023.

John Stavliotis at Pinnacle Summit Series 2023: The Boutique Edge

Antipodes Portfolio Manager, John Stavliotis uncovers the structural and cyclical opportunities in emerging markets and Antipodes’ pragmatic value approach to investing.

Meet the Manager: Jacob Mitchell Presentation

Jacob Mitchell discusses the outlook for global equities and Antipodes’ portfolio positioning in this presentation at the Morningstar Investment Conference.

Jacob Mitchell at Pinnacle Insights Live 2023: Global Equities

Antipodes CIO and Lead Portfolio Manager, Jacob Mitchell discusses a fundamentally different regime for global equities in 2023.

[In Brief] Identifying short positions

In this short video Jacob Mitchell shares insights into how the Antipodes team identifies short positions.

Jacob Mitchell at the Pinnacle Investment Summit 2022

Antipodes CIO and Lead Portfolio Manager, Jacob Mitchell outlines how Antipodes are navigating the shifting landscape with a pragmatic approach to value investing.

[In Brief] A regime shift in global equity markets

In this short video Alison Savas and Jacob Mitchell provide an update on the Antipodes team’s views on global equity markets.

[In Brief] Holding the line on China

A short video update covering Antipodes’ views on Chinese equities.

Jacob Mitchell on Livewire’s Buy, Hold, Sell segment

Jacob Mitchell joins host James Marlay on Livewire’s Buy, Hold, Sell segment for a look at six global stocks across Chinese and US markets.

Chris Judd’s Talk Ya Book: Alison Savas interview

Alison Savas explains Antipodes’ pragmatic value investment style and provides an in-depth overview of a key portfolio holding, Frontier Communications (NASDAQ: FYBR).

[In Brief] Why Antipodes has been building exposure to energy and commodity stocks

A short video update covering Antipodes views on the energy and commodity sectors amid the current global uncertainty, along with the longer term outlook for the sectors.

[In Brief] Putin’s war: markets, stagflation and portfolio positioning

A short video update from Alison Savas and James Rodda regarding the war in Ukraine.

[In Brief] The repricing of risk in global equities

In this short video update, Antipodes’ CIO, Jacob Mitchell, discusses the sharp moves seen in global equities during the first few weeks of 2022.

AGX1 Webinar: Outlook for global equities in 2022 and beyond

Jacob Mitchell provides insights into the AGX1 portfolio and discusses the outlook for global equities in 2022 and beyond.

ASX Investor Day: Pragmatic value and the decarbonation investment cycle

In this presentation, Alison Savas discusses Antipodes’ pragmatic value approach and explains why around 15% of the Antipodes Global Shares (Quoted Managed Fund) (ASX: AGX1) portfolio is positioned to provide exposure to decarbonisation.

Pinnacle Investment Summit 2021: Listed funds – the road ahead

In these panel sessions, Antipodes Managing Director, Andrew Findlay puts the opportunities and challenges facing Listed Investment Companies and ETFs under the microscope and speaks about the listed investment opportunities offered by Antipodes.

Jacob Mitchell: Where will all the stimulus go?

In this Livewire Markets interview, Jacob Mitchell discusses his views on investor behaviour in current markets, US stimulus, rising bond yields and details major longer-term investment themes Antipodes is building exposure to.

Pinnacle Insight Series: Alison Savas – where to for Global Markets?

Watch on demand: During the Pinnacle Insight Series 2021, Alison Savas discusses Antipodes’ views on the direction of global markets and where the greatest investment opportunities and risk lie.

Webinar: Why 2021 is the time to invest in Asian equities

In this webinar, Antipodes Asia Fund co-portfolio manager, Sunny Bangia outlines why now is a good time to invest in Asia and explains Antipodes current positioning and outlook for the region.

Quarterly Review Webinar: Q4 2020

Watch on demand: Alison Savas and Sunny Bangia discuss Antipodes’ outlook for global markets in 2021 and review the major market moves and events that shaped Q4, 2020.

Gaining exposure to Europe’s green future

Decarbonisation in Europe is a significant investment theme and we think investors should be thinking about how to position portfolios for what is a very long term cycle. Currently Antipodes’ portfolios have roughly a 12.5% exposure to this cycle.

Could extreme market cap/performance concentration signal a turning point?

Despite a global pandemic that has been sending shock waves through economies, market cap concentration has surpassed previous historical highs seen during the dot-com bubble. Could this be signalling a turning point?

Pinnacle 2020 Virtual Summit: Jacob Mitchell

In this 15 minute presentation at the Pinnacle 2020 Virtual Summit, Jacob Mitchell shares insights into Antipodes’ current approach to global investing and highlights 3 key investment themes offering compelling opportunities.